Atlantic City casinos and online betting companies prepare to challenge New Jersey's proposed tax hike

Thursday 27 de February 2025 / 12:00

2 minutos de lectura

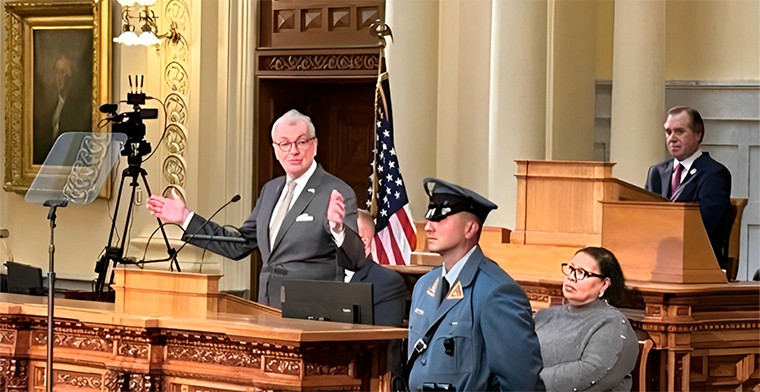

(Atlantic City).- Casinos, online betting companies and their political allies in both parties are gearing up for a fight against Governor Phil Murphy’s proposal to raise taxes on internet gambling and sports betting — the two fastest-growing parts of New Jersey’s gambling industry.

Casinos, online betting companies and their political allies in both parties are gearing up for a fight against Gov. Phil Murphy’s proposal to raise taxes on internet gambling and sports betting — the two fastest-growing parts of New Jersey’s gambling industry.

The Democratic governor suggested Tuesday in his budget proposal raising taxes on both forms of gambling to 25% each. Online sports betting is currently taxed at 13%, and internet gambling is taxed at 15%.

Murphy’s administration said the increases would raise $402.4 million.

That’s small change in a budget of over $58 billion, but it takes square aim at the two areas in which New Jersey’s gambling industry is growing and thriving. Last year, online sports betting in New Jersey brought in $138.3 million in tax revenue, and internet gambling generated $358.3 million in taxes.

Money won from gamblers at online casino games and sports betting must be shared with outside parties like sports books and tech platforms, and is not solely for the casinos to keep. But what is theirs to keep — money won from in-person gamblers at Atlantic City casinos — is declining.

Six of the nine casinos are winning less from in-person gamblers now than they did before the COVID-19 pandemic hit in early 2020.

“This is a terrible idea,” said Bill Pascrell III, a veteran gambling industry lobbyist representing numerous Atlantic City casinos, the Meadowlands Racetrack in East Rutherford and Monmouth Park in Oceanport. “We are going to run a very strong lobbying and public education campaign against this.”

The Casino Association of New Jersey on Tuesday came out strongly against the proposal, saying it would “threaten the stability of Atlantic City’s gaming and tourism industry, as well as the industry’s workforce.”

“These are very challenging times for the Atlantic City casino industry and its employees,” the association said in a statement. “Tourism is down and visitation has decreased at our brick-and-mortar casinos.

“This unnecessary tax proposal, against the backdrop of a weakened economic climate, would jeopardize our properties and ultimately hurt the working-class people it supports,” the casinos said. “We strongly urge lawmakers to oppose any legislation, including this bill, that would deter business and hinder our ongoing efforts to transform Atlantic City into a leading beachfront resort destination.”

And Jeremy Kudon, president of the Sports Betting Alliance, an industry group including FanDuel, DraftKings, BetMGM and Fanatics Sportsbook, called the proposal “a wrong turn for New Jersey.”

Increasing taxes on internet casino games and sports betting will jeopardize thousands of jobs and hundreds of millions of dollars in revenue the industries have generated in New Jersey, Kudon said. “Any effort to increase sports betting taxes on New Jerseyans threatens all of that progress,” he said.

It remains to be seen how much support there is in the Democrat-controlled Legislature for the tax increases. A bill introduced last April by Sen. John McKeon, D-Morris, that would raise the rate to 30% on both forms of gambling has sat quietly in a committee without consideration.

Two influential state senators — one from each party — say they oppose Murphy’s tax hike plan.

Sens. John Burzichelli, D-Salem, Gloucester, Cumberland, and Michael Testa, R-Cape May, Cumberland, Atlantic, said the proposal unwisely targets a successful endeavor.

Increasing the tax to 25% “is putting a New Jersey success story at significant risk,” the senators said in a statement. “Any effort to increase this tax on New Jerseyans threatens all of the progress New Jersey has made, especially at levels that would make New Jersey’s customers too heavily taxed. A tax increase would negatively impact jobs, industry investment, and our New Jersey customers, and it could affect future revenue growth for the state.”

Sen. Vince Polistina (R-Atlantic) said the Legislature should adopt the 5% across-the-board tax cuts Murphy floated late last year instead of raising taxes.

“Lower taxes on Atlantic City gaming operations has resulted in significant investment,” he said. “Given the challenges in Atlantic City and with New York gaming on the horizon, I believe the tax rates on all gaming operations should remain the same so that we don’t jeopardize potential investment in the City.”

The taxes are paid by the operators of sportsbooks and online casinos, not by people making bets (though individual gamblers are required to report gambling winnings as personal income at tax time). But analysts fear the companies will pass along the added cost of the taxes to consumers.

The Wall Street firm Jefferies Equity Research predicted the higher tax rates could cost Flutter, the parent company of FanDuel, $106 million, adding customers could see fewer free bets and less favorable odds as a result.

It also predicted that Entain, a co-owner of BetMGM, could take a $62 million hit to its revenues, according to the website completeigaming.com.

Pascrell said New Jersey’s online gambling and sports betting industry has created 24,000 new jobs in the state since internet gambling began in 2013 and sports betting started five years later.

“We’re talking about further studios for live-dealer games, and data centers for the industry,” he said. “You think companies are going to want to invest in New Jersey now?”

Wayne Parry

Categoría:Gaming

Tags: Sin tags

País: United States

Región: North America

Event

Peru Gaming Show 2025

18 de June 2025

Facephi presented its digital identity verification solutions for the online gaming sector in Peru at PGS 2025

(Lima, SoloAzar Exclusive).- Facephi is consolidating its position as a strategic partner for responsible online gaming in Peru, presenting advanced identity verification, fraud prevention, and regulatory compliance solutions at PGS 2025, adapted to an increasingly digital and demanding ecosystem. In this interview, Bruno Rafael Rivadeneyra Sánchez, the firm's Identity Solutions Senior Manager, explores how its technology is redefining gaming security standards, with a preventative, seamless, and 100% regional approach.

Friday 18 Jul 2025 / 12:00

From PGS 2025, Win Systems Redoubles its Commitment to Peru: Innovation, Proximity, and Regional Expansion

(Lima, SoloAzar Exclusive).- In a revealing interview, Galy Olazo, Country Manager of Win Systems in Peru, analyzes the company's strategic role in one of the most thriving markets in the region. Its participation in the PGS 2025 trade show not only left its mark with its technological advances, such as the new Gold Club Colors electronic roulette wheels and the WIGOS management system, but also reaffirmed its commitment to the transformation of the sector and its consolidation in Latin America.

Tuesday 15 Jul 2025 / 12:00

Key debate during PGS 2025: Enforcement: Process to ensure compliance (laws, norms, rules)

(Lima, SoloAzar Exclusive).- During the 2025 edition of the Peru Gaming Show, the conference ‘Enforcement: Process to ensure compliance (laws, norms, rules)’ took place, with an international panel of professionals who debated about the current challenges to combat illegal gaming and guarantee the application of the laws in the sector, both in Peru and in the Latam region.

Monday 14 Jul 2025 / 12:00

SUSCRIBIRSE

Para suscribirse a nuestro newsletter, complete sus datos

Reciba todo el contenido más reciente en su correo electrónico varias veces al mes.